China's Major Banks Set to Boost Lending Amid Capital Support

CreditSights noted that fee income might rebound as well if newly implemented stimulus measures prove successful.

China’s Big 5 banks are anticipated to see an improvement in their net interest income (NII) due to a smaller decrease in margins and strong loan expansion.

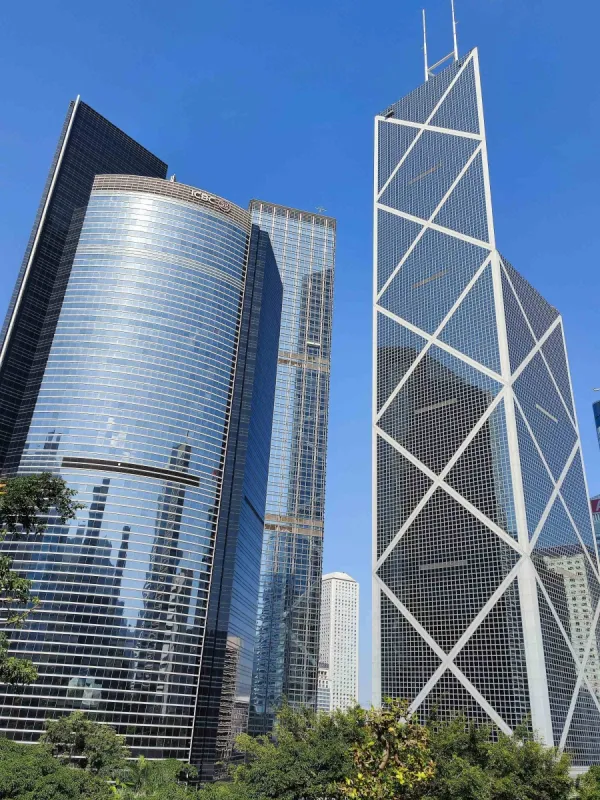

The expected equity injection Specifically at the Bank of China (BOC), China Construction Bank (CCB), and Bank of Communications (BOCOM), the Ministry of Finance is expected to contribute to expanding their loan portfolios, according to CreditSights, which is part of Fitch Solutions.

CreditSights stated that the increase in loan growth expectations comes alongside the injection.

The banks’ fee income may also recover if new stimulus policies are effective and the capital market rebound is sustained, whilst other non-interest income might be lower at least in Q1 due to recent yield volatility.

The operational performance metrics of the five banks—including the Agricultural Bank of China (ABC)— Industrial and Commercial Bank of China (ICBC) , BOC, CCB, and BOCOM — experienced a modest upturn in the latter part of 2024. As a result, they were able to announce minor YoY profit increases ranging from approximately 0.5% to 4.7% for the fiscal year 2024, according to CreditSights.

Nevertheless, the net interest margins (NIM) decreased by 18 to 19 basis points across the Big 4 banks, while BOCOM saw an independent decline of 1 basis point.

CreditSights stated that while NIMs are anticipated to keep decreasing this year, the reduction is projected to be less significant compared to the fiscal year 2024.

Fee income dropped by 3-14% year over year due to reduced fees in bancassurance and equity funds, poor consumer confidence, and diminished credit commitment fee rates.

CreditSights noted that other non-interest income significantly boosted profits in FY24, thanks to increased trading and investment earnings despite reduced market yields.

In fiscal year 2024, gross loans expanded by 8-10% compared to the previous year, mainly due to an increase in corporate lending. Nevertheless, the loan growth in the second half of 2024 softened to just 1%-2%, with discounted bills being the primary driver during this period.